Cap On Social Security Tax 2025. In 2025, 2025, and 2025, beneficiaries enjoyed respective increases to. We call this annual limit the contribution and benefit base.

That would mean, starting in 2025, americans earning $250,000 or more would pay a social security tax on all of their earnings. Social security’s primary revenue source is payroll taxes.

What Is The Cap For Social Security Tax In 2025 Karna Martina, We call this annual limit the contribution and benefit base. 50% of anything you earn over the cap.

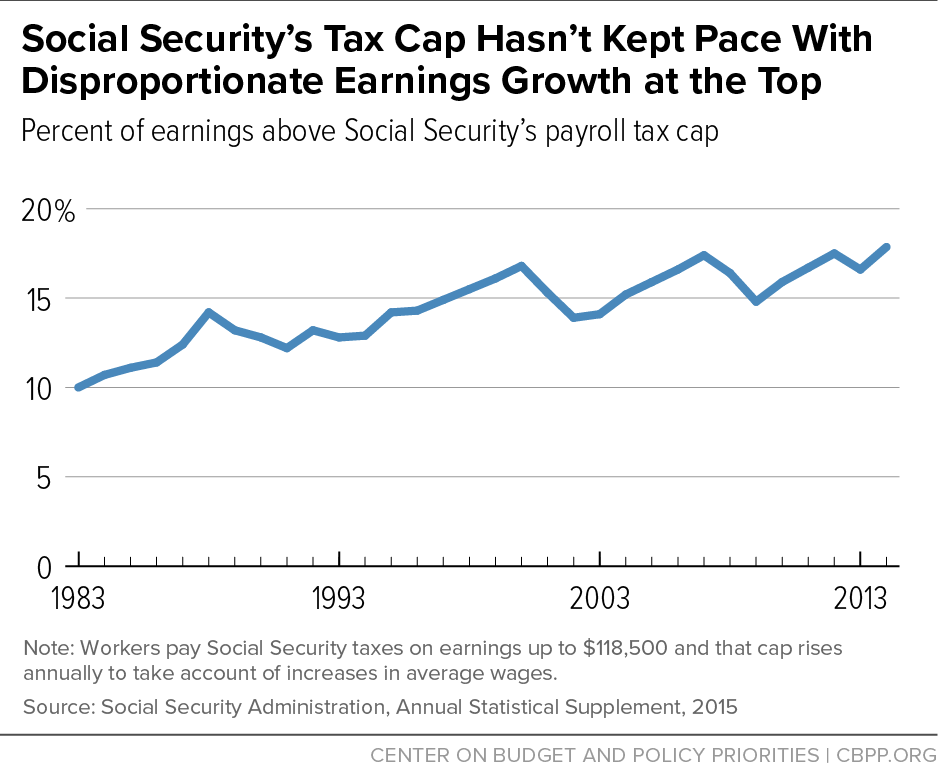

Social Security's Tax Cap Hasn't Kept Pace With Disproportionate, Cola is the tool tackling that task. The bill contains two main provisions:

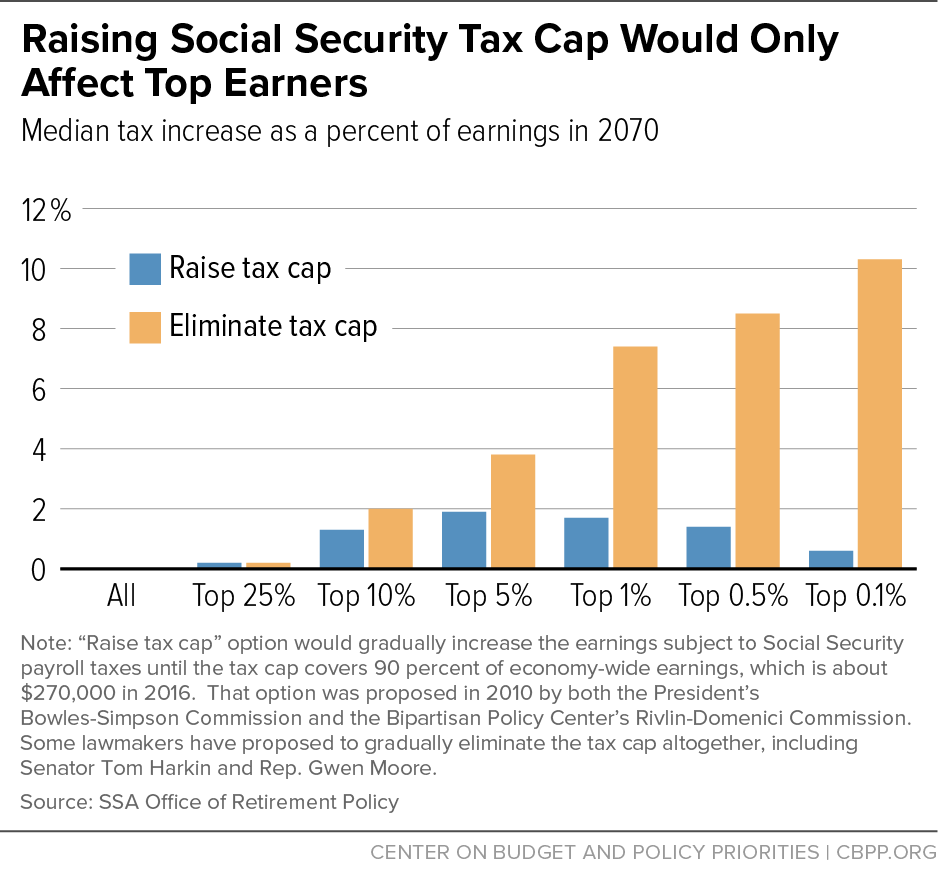

Raising Social Security Tax Cap Would Only Affect Top Earners Center, Small cap stocks large cap stocks. Cola is the tool tackling that task.

Social Security Byanugrahduria, Assessment of social security payroll taxes on incomes of. For 2025, that maximum is set at.

What Is The Cap On Social Security Tax? Retire Gen Z, In 2025, that cap is likely to rise so that higher. Any income you earn beyond the wage cap amount is not subject to a 6.2% social security payroll tax.

Who Pays if We Raise the Social Security Payroll Tax Cap? Center for, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Elimination of federal income tax on social security benefits.

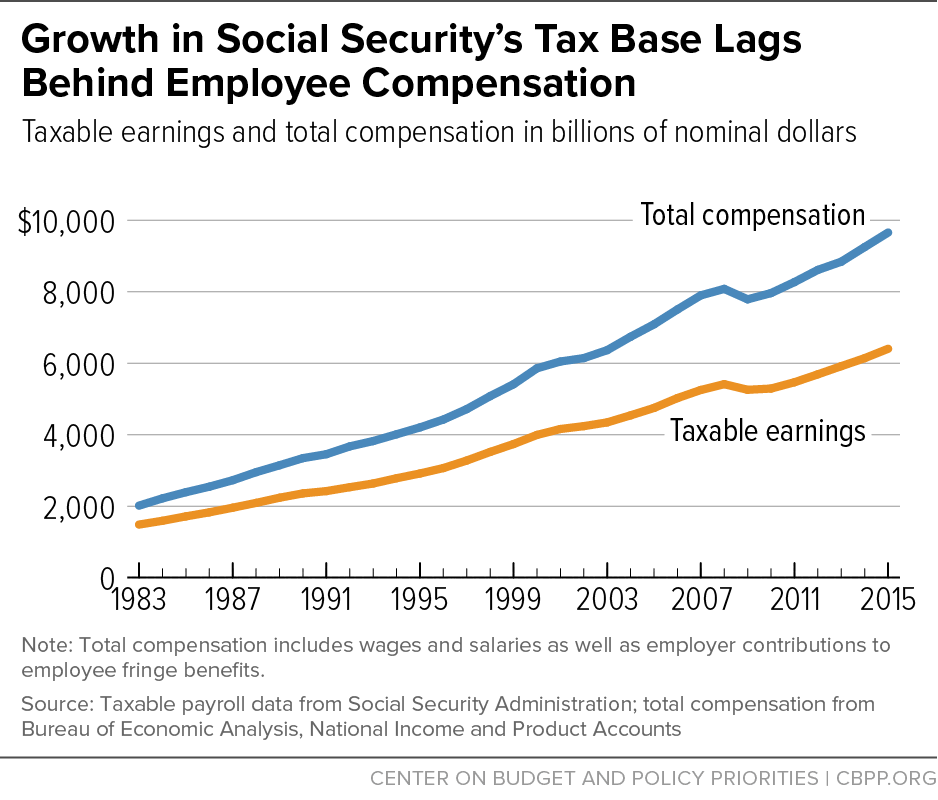

Increasing Payroll Taxes Would Strengthen Social Security Center on, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. Cola is the tool tackling that task.

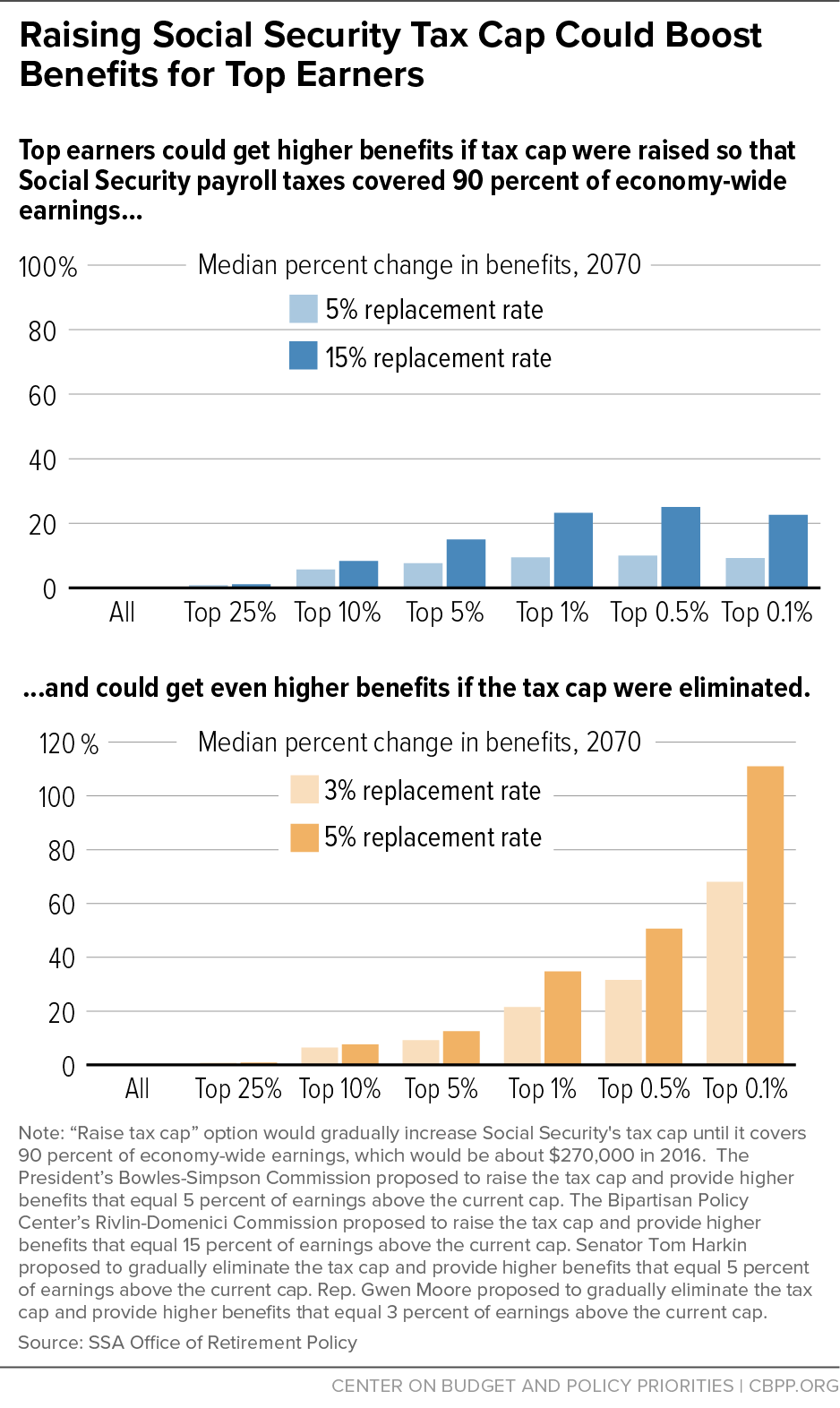

Raising Social Security Tax Cap Could Boost Benefits for Top Earners, Here are three social security changes coming in 2025 that may surprise many americans. Over the past five years or so, the social security tax limit has increased by an average of about $3,960 a year.

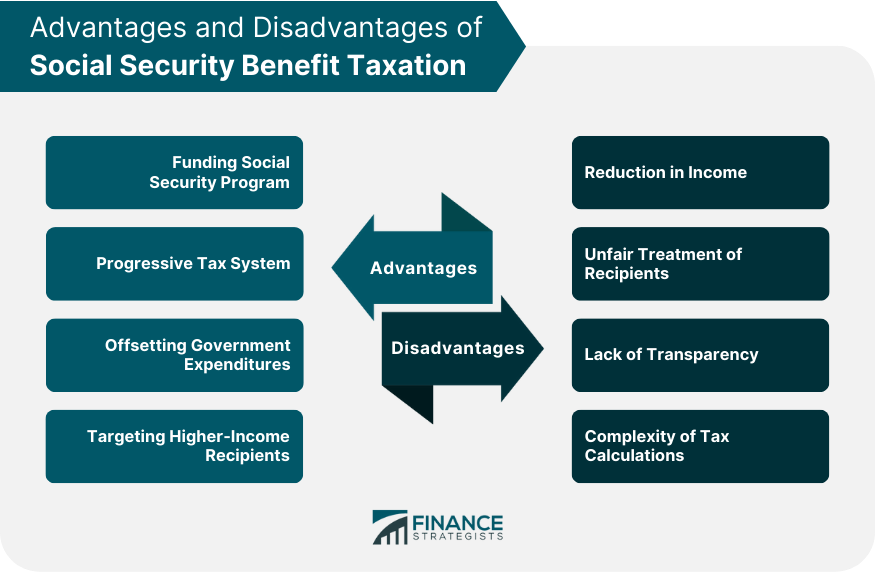

Social Security Benefit Taxation Meaning, Exclusion, Pros, Cons, The social security administration (ssa) announced that the maximum earnings subject to social security (oasdi) tax will increase from $160,200 to $168,600. The tax is currently capped at.

Social Security Tax Cap 2025 Elka Martguerita, In 2025, that cap is likely to rise so that higher. The limit is $22,320 in 2025.

The limit on annual earnings subject to social security taxes is referred to as the taxable maximum or the social security tax cap.