Massachusetts Capital Gains Tax Rate 2025. Capital gains tax is the tax you owe on your capital gains (profit) from the sale of a capital asset or investment just as a home. Long term capital gains from dividends, interest, wages, and other income:

But beware that the capital gains will be included in the calculation and could put you over the threshold. You can calculate this by.

But beware that the capital gains will be included in the calculation and could put you over the threshold.

![Massachusetts Capital Gains Tax [2025] Pavel Buys Houses](https://image-cdn.carrot.com/uploads/sites/36702/2021/09/capital-gains-tax-selling-home.png)

Massachusetts Capital Gains Tax [2025] Pavel Buys Houses, You can calculate this by. This bill closes that loophole for tax years beginning january 1, 2025, requiring consistency in filing status at the federal and state level.

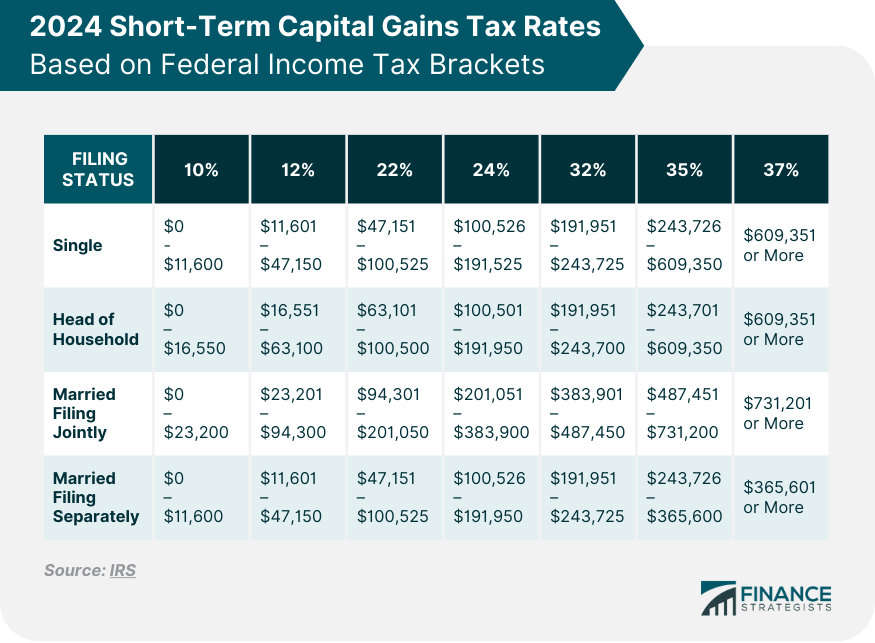

tax brackets for estates and trusts for 2025 & five earlier years, What are the capital gains tax rates for 2025 vs. You can calculate this by.

Capital Gains Tax Brackets For 2025 And 2025 Your Insurance Services, You can calculate this by. Third, if your income is more than $415,050 for a single person and.

Capital Gains Tax Brackets For 2025 And 2025, For income exceeding $1,053,750, there is an additional surtax of 4%. Massachusetts state income tax tables in 2025.

Capital Gains Tax Rate 2025 Overview and Calculation, You earn a capital gain when you sell an investment or an asset for a profit. The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held the property sold.

How Much Is Capital Gains Tax on Real Estate? How To Avoid It , Capital gains in massachusetts are taxed at one of two rates. The income tax rates and personal allowances in massachusetts are updated annually with new tax tables published for.

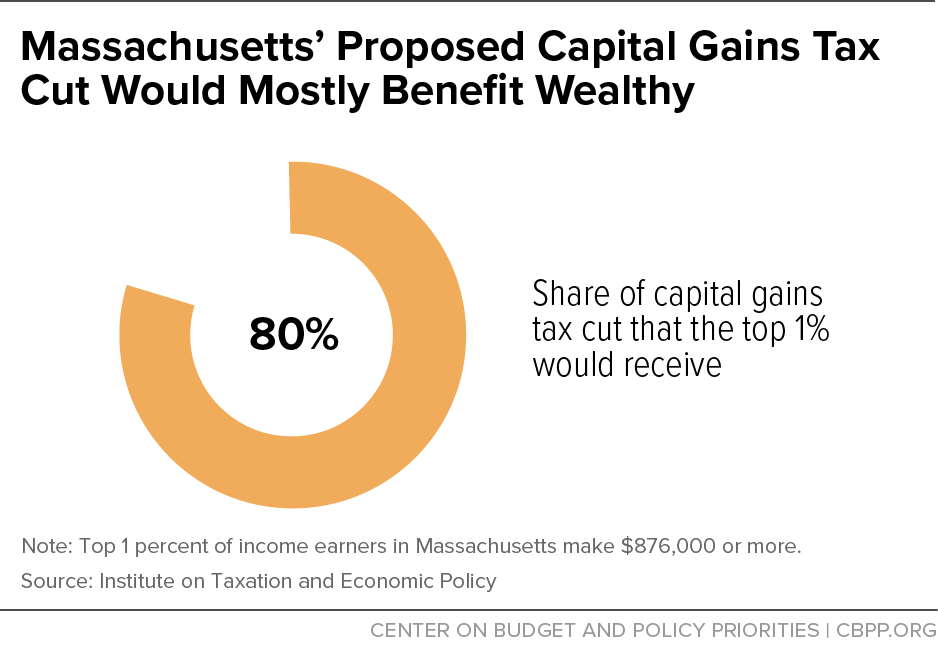

Massachusetts’ Proposed Capital Gains Tax Cut Would Mostly Benefit, For tax year 2025, for income exceeding $1,000,000, there is an additional surtax of 4%. Below these limits, you don’t owe the tax.

The Difference Between ShortTerm and Long Term Capital Gains, Long term capital gains from dividends, interest, wages, and other income: You can calculate this by.

House Democrats Capital Gains Tax Rates in Each State Tax Foundation, What are the capital gains tax rates for 2025 vs. Capital gains in massachusetts are taxed at one of two rates.

UK tax rates Landlords Tax Services > Tax info, You can calculate this by. But new for the 2025 filing season, an additional 4% tax on 2025 income over $1 million will be levied, making the highest.

But beware that the capital gains will be included in the calculation and could put you over the threshold.