Tax Brackets For 2025 Married. Edited by patrick villanova, cepf®. Here are the tax brackets according to income for the 2025 tax year:

Taxable income and filing status determine which federal tax rates apply to. You will pay 10 percent on taxable income up to $11,600, 12 percent on the amount over $11,600 to $47,150, and 22 percent above that (up to $100,525).

Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of.

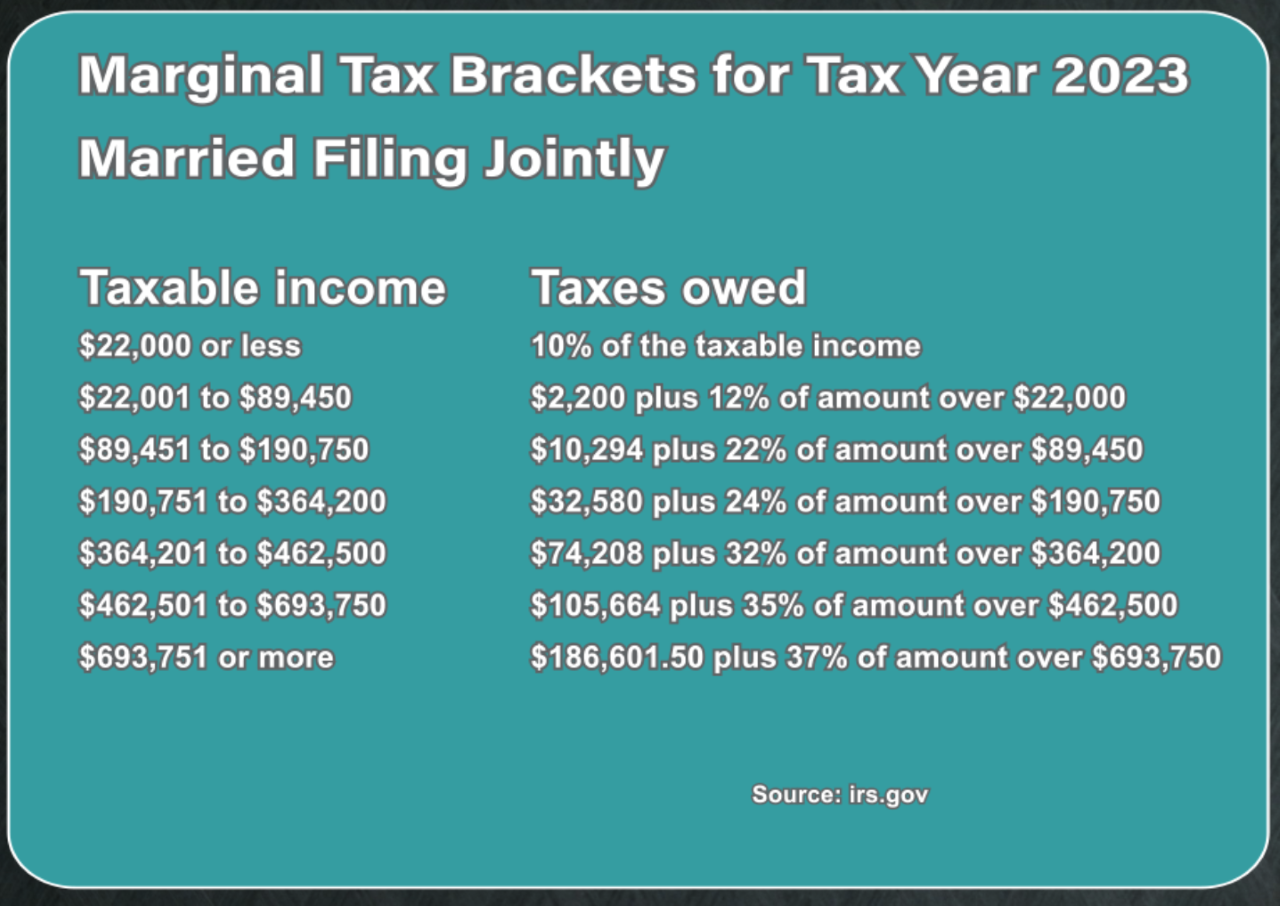

Irs Tax Brackets 2025 Married Jointly Latest News Update, In 2025 and 2025, there are seven federal income tax rates and brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Changes for 2025 What You Need to Know Guiding Wealth, You pay tax as a percentage of your income in layers called tax brackets. The top marginal income tax.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. For 2025, the maximum earned income tax credit (eitc) amount available is $7,830 for married taxpayers filing jointly who have three or more qualifying children—it.

What Is My Tax Bracket 2025 Blue Chip Partners, Want to estimate your tax refund? 37% for income greater than $731,200.

2025 Tax Brackets Calculator Nedi Lorianne, The federal income tax has seven tax rates in 2025: The tax rates and brackets for 2025 are.

20232024 Tax Brackets and Federal Tax Rates NerdWallet, 37% for income greater than $731,200. Taxable income and filing status determine which federal tax rates apply to.

IRS New tax brackets for 2019 affect earned this year, You will pay 10 percent on taxable income up to $11,600, 12 percent on the amount over $11,600 to $47,150, and 22 percent above that (up to $100,525). 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

2025 Tax Brackets And The New Ideal, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37. The federal income tax has seven tax rates in 2025:

IRS Tax Brackets AND Standard Deductions Increased for 2025, Tax questions often have complex answers, and the question of federal tax brackets is no different. Married filing jointly, surviving spouse:

IRS Announces Inflation Adjustments to 2025 Tax Brackets The Economic, Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of. Updated on december 16, 2025.

The federal income tax rates remain unchanged for the 2025 tax year at 10%, 12%, 22%, 24%, 32%, 35% and 37%.